Written by: John G. on 18 June 2024

The national anthem lies about our country. There’s golden soil in Australia but the natural wealth is not for toil.

It’s like there’s two Australias: a corporate wonderland for foreign investors and a labour camp of battling to make ends meet for hard working people in the one nation.

Exports of coal, iron ore, natural gas, and some other resources from Australia are the largest in the world.

The mining, oil and gas industries produce more than half Australia’s goods exports. The industries’ exports of $455 bn are equivalent to 24% of the country’s economic output. Corporate monopolies plunder the country’s resources.

The mining, oil and gas corporations are making a bundle. Those corporations alone picked up a cool $241.9 bn operating profit before tax in 2022-23.

Corporate thrive while people struggle

Citizens are told the country is on its knees, in debt and struggling. More and more people are battling with bills, rent or mortgages. The cost of living has gotten away from people.

In 2022, over three million (3,319,000), of the nation’s 26 million people lived in poverty, including 761,000 children. That’s based on a measure of 50% of median household income, $489 per week for a single person, $1,027 per week for a couple with two children.

More than one in eight people (13.4%) and one in six children (16.6%) lived below the poverty line after taking account of their housing costs.

That was before the inflation/ interest rate crisis took hold. Things got far worse in the first half of 2024.

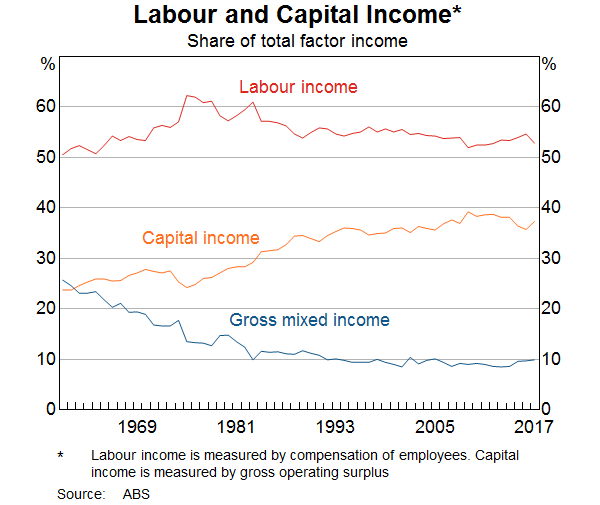

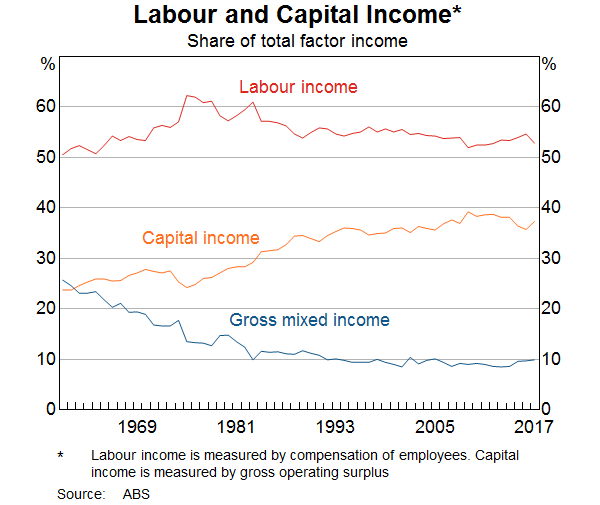

That’s built on top of the situation of the workforce being on the slide since the mid-1970s. Then the labour share of national income was just over 60%. Now its down near 50%. Capital income, the corporations, picked up what people lost and some more, jumping from 23% to 38% of national income. .

We’re told the government is doing what it can. There’s not great comfort in that sales pitch but it’s doing more than the miserable Libs would do. Still its paltry compared to what could be done if our natural resources were used to look after people, not load profits into billionaire corporates.

There are two Australias. Our country is on its knees but the rich mining, oil and gas corporate monopolies’ country is rolling in billions.

Aladdin’s Cave of Treasures for the Foreign Corporates

Our nation is the world’s sixth largest in area after Canada, Russia, China, the USA, and Brazil. The economy, at $1,702 billion, is the 13th largest in the world according to the IMF with just 0.33% of the world’s population. Australia ranks around 55th on national population counts internationally. The country is full of natural riches, a capable workforce and lots of modern infrastructure.

Exports of coal, iron ore, other fossil fuels, gold, copper, aluminium and other minerals amounted to $406 billion in 2023. [Australia’s Top 25 Exports, Goods and Services, DFAT;]

Australia has been the world's largest exporter of iron ore, coal, unwrought lead, 2nd largest exporter of aluminium ores, beef, lentils and cotton, the 4th largest exporter of liquefied natural gas (2017) and 5th largest exporter of wine .

Since then, Australia overtook Qatar to become the world’s largest exporter of LNG for the first time in November 2018 . Australia now vies with Qatar and the United States as the world's biggest LNG exporter, having boosted export capacity over the past decade, mainly by building three export terminals on the east coast, which use coal-seam gas as a feedstock.

Foreign owners are at the core of the plundering

Contrary to perceptions encouraged by big mining monopolies, major ‘Australian’ mining companies are not Australian owned. They don’t even have large minority Australian-owned shareholdings. An Australia Institute study in 2022 drew the curtain on that nonsense.

The ‘Big Australian’ BHP Group Ltd with a market capitalisation of $252.81bn is 94.41% foreign-owned. Rio Tinto Ltd’s shares, valued at $182.08 bn, were 95.16% foreign-owned. That mightn’t surprise but even a corporation with a prominent local face, Fortescue Metals Group, much touted as owned by ‘Twiggy’ Forrest, was 89.16% foreign-owned in March 2022 [Foreign Investment in Australia, Australia Institute, revised 10/2023; ]

Across corporations generally, that study found an overall figure of around 30% identifiable Australian ownership of Australian companies, and in turn, around 70% foreign ownership of listed companies in Australia. Even often-touted household shareholdings amount to less than 10% of ownership and have little or no real say. Superfunds investments are only a smidgen more, according to the Australia Institute. And despite making huge profits, 1 in 3 big corporations still pays no tax.

The mining, oil and gas industries including exploration and support services, employed 220,000 people in June 2023 of the total national workforce of 14,355,100 employed. That’s just 1 employee in each 67 who are employed by the resource plunderers. [Australian Industry, ABS, 31/5/2024; and Labour Force, Australia, ABS 13/6/2024]

There’s more people involved in the supply chains for the mining, oil and gas industries needed to build mines, etc, and get the resources out of the country. The Minerals Council reckons that all adds up to 1.1 million people. But those numbers are a fair bit of smoke and mirrors. [Mining sustains Australia in uncertain times, Mineral Council of Australia Media release, 9/1/2023]

Mining, Oil and Gas corporates' best interests are to let most people starve

The resource corporates are 85% foreign-owned, and they need just 1 in 67 of us to get the stuff out of the ground and to ports. They make billions from the business.

Mining, oil and gas corporates don’t have to give a damn about how hard the other 66 workers here are doing in a cost-of-living crisis. And they don’t.

Look at what they paid in taxes and royalties last year. “The mining and minerals industries paid a record (sic) $74.0 billion to federal, state, and territory governments in taxes and royalties.” Talk about a pathetic record when compared to their exports of $406bn and profits before tax of $242 bn. [Australian Minerals Sector Achieves Record Tax and Royalty Payments, Mineral Council of Australia Media release, 26/5/2024]. The figure paid leaves out the $14 bn of government subsidies paid to the oil and gas monopoly corporates.

In fact, the resources corporates have interests in making sure nothing is done to make things better for people across the country. That would eat into profits the corporate monopolies make from their mining operations here.

They can keep plundering Australia’s natural resources with the fraction of the local workforce they employ whatever is happening to the rest of us. It makes the mining monopolies among the most reactionary enemies of the working class in this country alongside their finance sector corporate connections.

Make the rich mining, oil and gas corporates pay for our natural resources.

For now, the foreign-owned corporate monopolies rule over the people, workers included. They made $242 bn before tax last year.

Hit them up for half that, $120 bn. They pay out $60bn now. That would add an extra $60 bn to the Federal budget, a big addition to the $698 bn budget this year. It’s a lot of extra government services.

If workers were in charge, just think about what those billions the corporate mining monopolies would be paying over to help out people in trouble could do; fix up Medicare and the NDIS, free public education, childcare and universities, open up free health clinics all over the country, free up public transport. With the workers supported and freed up from cost of living squeeze to an extent, small and medium consumer businesses could thrive, allying their interests with the workers.

First Nations communities should have first call on funds for their communities, given their country being exploited was seized from them and never ceded. The harms are graphically revealed in numerous incidents like the Rio Tinto destruction of Juukan Gorge, let alone First Nations people’s conditions of life.

The Queensland government recently increased coal royalties to 20% to 40% depending on the level of international prices. They promised to invest in hospitals and housing. We’ll see what comes of that but the increase is a first and an overdue change from the Liberal National Party 10-year freeze on coal royalties at piddling 7% to 15% rates.

The taxes and royalty being paid by mining, oil and gas monopolies are pathetic next to countries like Norway, Qatar, Saudi Arabia, and even the UK.

Saudi Arabia charges royalties on production values at international pricing of 20% of the value of production up to a base level ($70 per barrel for oil), stepped up to 40% for the next portion of higher prices ($30), stepped up to 50% for prices at the next level ($100/barrel). At a 20% rate, the mining, oil and gas exporters in Australia would pay $93 bn in royalties alone.

The UK charges a windfall oil and gas profits tax when prices spike above historic standard rates. The UK Energy Profits Levy is charged at an extra 25 percent on top of the UK headline tax rate of 40% Corporation Tax. The rate of corporate tax on oil and gas enterprises in the UK is 65%. Here its nominally 30% but the tax paid is a small fraction of that.

Make the rich mining, oil and gas corporate monopolies pay up.

These monopolies plunder the nation’s natural riches.

Their interests are currently decisive in the running of the country. They have no interest aligned with the welfare of the country, let alone the people, working people, First Nations, professionals and many small and medium businesses.

Foreign-owned corporate monopolies have no right of ownership over the natural resources of the nation.

The call to make them pay and use the funds to benefit the people is the least we can raise.

It has very widespread support, and greater support at a time when many people are doing it so tough. People need these changes.

The working class can stand together to build working class power here against foreign-corporate monopolies, and bring forward others to join the front against foreign corporates.